IRS extends tax filing deadline to July 15

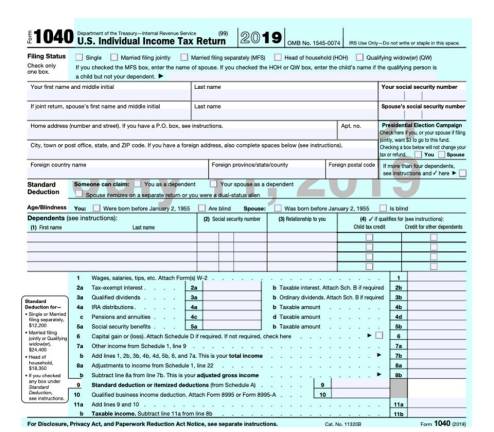

Community. While societal and business changes seem to happen at lightning speed recently, tax season is fast approaching, and many Americans will need more time to get their taxes done. The IRS has therefore extended the federal tax filing deadline to July 15 in response to the impact the novel coronavirus (COVID-19) is having on individual and business taxpayers.

On Friday, March 20, following bipartisan congressional requests, the U.S. Secretary of the Treasury announced that the Internal Revenue Service (IRS) will now extend this year’s federal tax filing deadline to July 15, 2020, in direct response to the impact that the novel coronavirus (COVID-19) is having on American taxpayers and businesses.

U.S. Congressman Josh Gottheimer (NH-5), along with U.S. Congressman Paul Mitchell (MI-10), had asked to extend the filing deadline to provide relief from filing and payment penalties, and cited reports that accounting firms are unable to operate out of public health concerns, at a time when they are normally experiencing the highest demand in their business.

This extension comes after the Treasury Secretary’s announcement of a 90 day extension to the federal tax payment deadline.

“Now that the deadline to file and pay federal taxes has been extended to July, this will allow North Jersey residents more flexibility to pay for their housing, child care, and medical care, and to help small businesses pay employees at a time when consumer demand is unpredictable,” Congressman Josh Gottheimer (NJ-5) said today. “Now, more than ever, American taxpayers and local businesses need relief from filing and payment penalties. For North Jersey and other communities currently impacted by COVID-19, the focus should be on the health and safety of themselves, their families, and their residents.”